Investor Relations

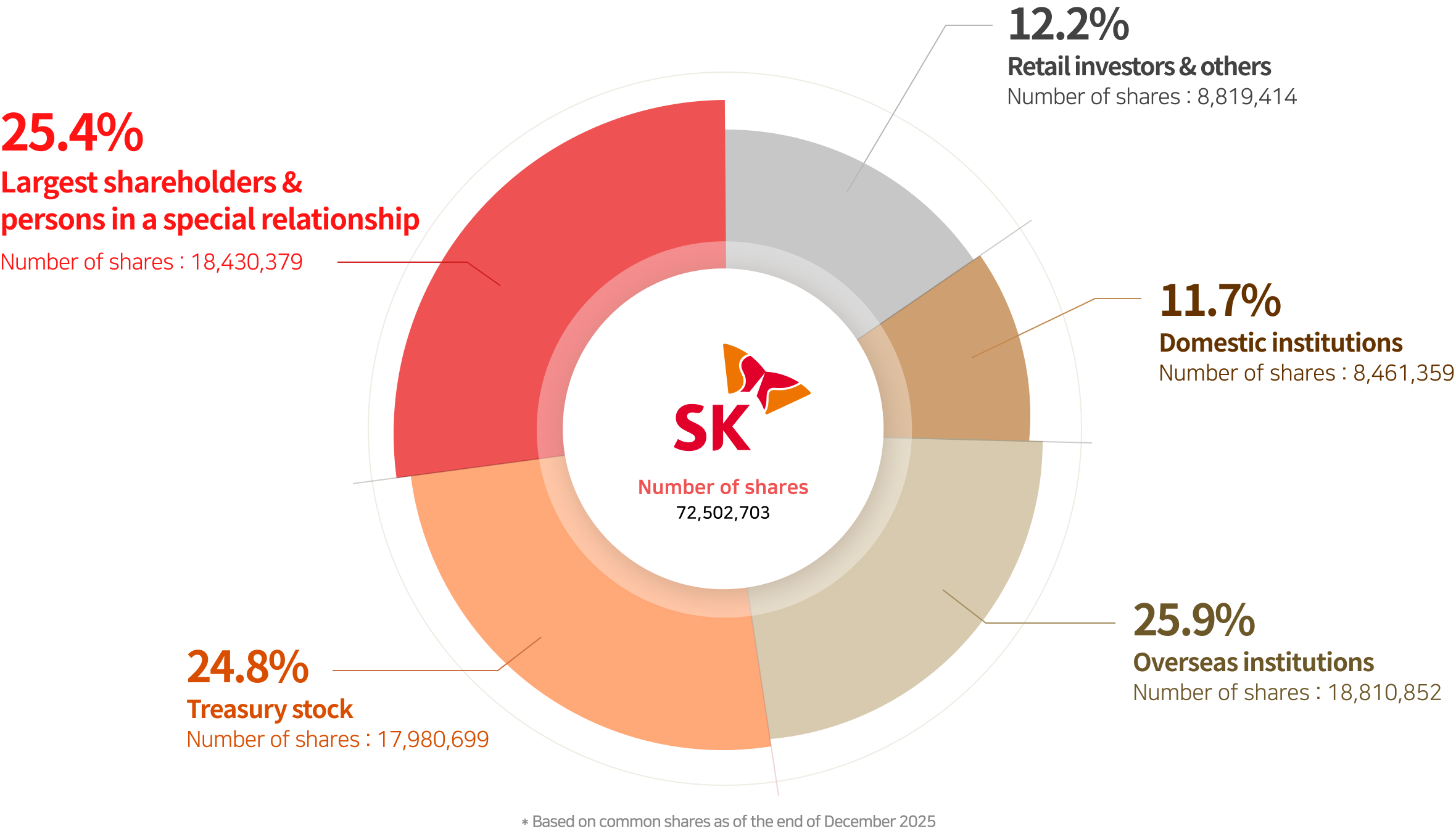

Shareholders

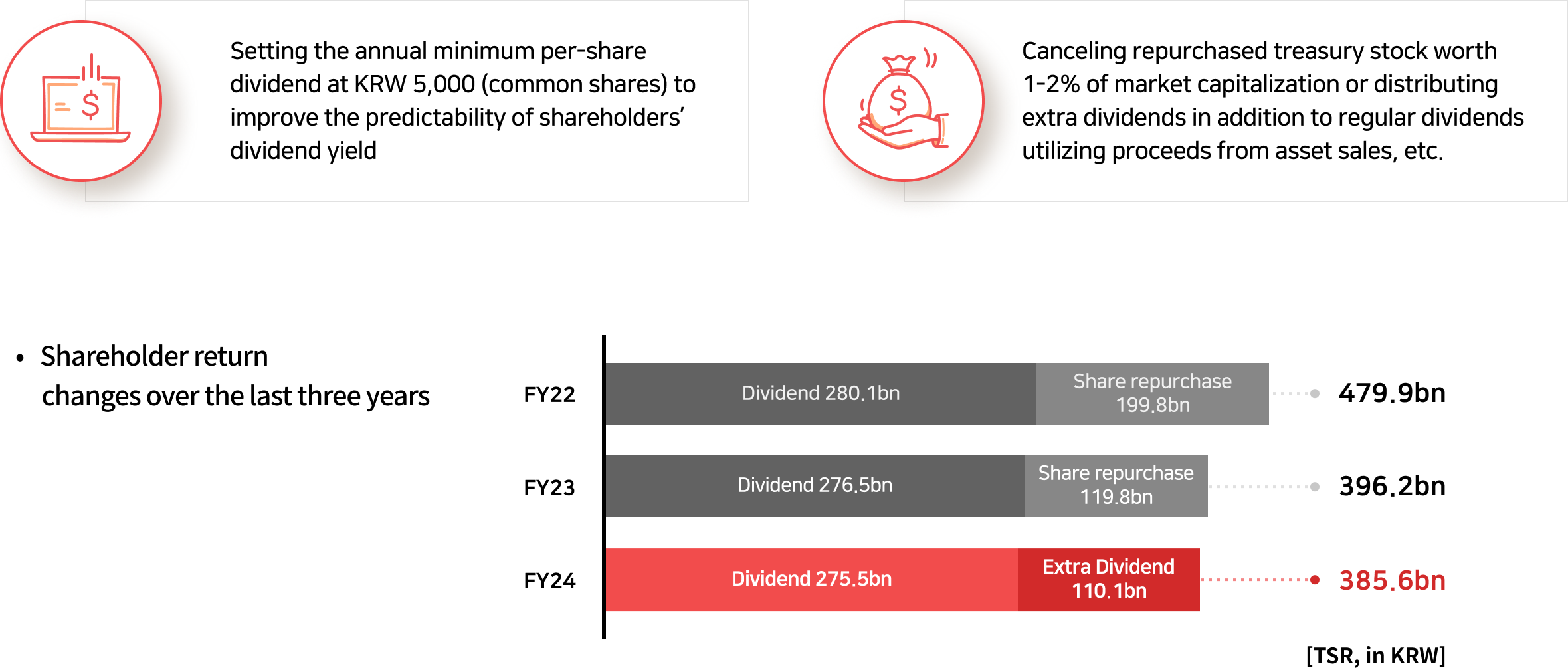

Shareholder Return Plan for FY24-FY26

Maximizing shareholder value by achieving gradual shareholder return expansion based on stable and predictable basic dividends and proceeds from asset sales, etc.

Setting the annual minimum per-share dividend at KRW 5,000 (common shares) to improve the predictability of shareholders’ dividend yield

Canceling repurchased treasury stock worth 1-2% of market capitalization or distributing extra dividends in addition to regular dividends utilizing proceeds from asset sales, etc.

* Shareholder return changes over the last three years

- Dividend 280.1bn | Share repurchase 199.8bn = 479.9bn

- Dividend 276.5bn | Share repurchase 119.8bn = 396.2bn

- Dividend 275.5bn | Extra Dividend 110.1bn = 385.6bn

Shareholder Return

| Category | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Face value per share (KRW) | 200 | 200 | 200 | 200 | 200 | 200 | 200 | 200 | 200 | ||

|

(Separate) Net income (KRW 1 million) |

-745,893 | 362,974 | 544,415 | 1,499,764 | 1,716,045 | 1,420,543 | 1,453,631 | 612,121 | 641,694 | ||

| Earnings per share (KRW) | -13,534 | 6,514 | 9,629 | 28,456 | 32,732 | 25,632 | 25,988 | 10,924 | 11,457 | ||

|

Total Dividends (KRW 1 million) |

385,621 | 276,469 | 280,149 | 447,594 | 370,124 | 267,892 | 281,971 | 225,582 | 208,666 | ||

|

(Separate) Dividend payout ratio (%) |

N/A | 76.2% | 51.5% | 29.8% | 21.6% | 18.9% | 19.4% | 36.9% | 32.5% | ||

|

Dividend yield (%) |

Common shares |

5.0% | 2.6% | 2.5% | 3.1% | 2.9% | 1.9% | 1.9% | 1.4% | 1.6% | |

|

Preferred shares |

5.8% | 3.4% | 2.9% | 3.6% | 2.9% | 2.8% | 3.7% | 2.5% | 2.7% | ||

|

Dividend per share (KRW) |

Common shares |

7,000 | 5,000 | 5,000 | 8,000 | 7,000 | 5,000 | 5,000 | 4,000 | 3,700 | |

|

Preferred shares |

7,050 | 5,050 | 5,050 | 8,050 | 7,050 | 5,050 | 5,050 | 4,050 | 3,750 | ||

|

Purchase of treasury stock (KRW 1 million) |

- | 119,753 | 199,763 | - | - | 905,919 | - | - | - | ||

|

Total shareholder return (KRW 1 million) |

385,621 | 396,222 | 479,912 | 447,567 | 370,124 | 1,173,811 | 281,971 | 225,582 | 208,666 | ||

* Based on the separate financial statement of the respective fiscal year (not reflecting ex-post adjustment of profit and loss as a result of suspended projects in the following year)

Annual General Meeting of Shareholders

- Date/Time: Wednesday, March 26, 2025 9:00AM (Local Time)

- Place: Jongro 26, Jongno-gu, Seoul, Korea

Results

| Agenda | Total Voting Shares |

Shares Voted |

Attendance Rate (Excl. Largest Shareholder & Specially Related Persons) |

Result | Votes For (Percentage) |

Votes Against / Abstentions (Percentage) |

|

|---|---|---|---|---|---|---|---|

| No. 1 | Approval of Financial Statements for the 34th Fiscal Year (2024) | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 38,396,818 (96.0%) |

1,581,085 (4.0%) |

| No. 2 | |||||||

| No. 2-1 | Appointment of an Inside Director (Chey, Tae-won) | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 33,257,425 (83.2%) |

6,720,478 (16.8%) |

| No. 2-2 | Appointment of an Inside Director (Kang, Dong Soo) | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 36,605,235 (91.6%) |

3,372,668 (8.4%) |

| No. 2-3 | Appointment of an Outside Director (Lee, Kwan Young) | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 39,164,917 (98.0%) |

812,986 (2.0%) |

| No. 2-4 | Appointment of an Outside Director (Jeong, Jong Ho) | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 30,677,938 (76.7%) |

9,299,965 (23.3%) |

| No. 3 | Appointment of an Outside Director for the Audit Committee (Kim, Seon Hee) | 34,269,487 | 19,912,041 | 22.6% | Approved as originally submitted | 16,236,690 (81.5%) |

3,675,351 (18.5%) |

| No. 4 | Approval of the Ceiling Amount of Remuneration for Directors | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 29,048,588 (72.7%) |

10,929,315 (27.3%) |

| No. 5 | Approval of Amendments to Terms of Severance Payments to Executives | 54,355,349 | 39,977,903 | 54.5% | Approved as originally submitted | 39,323,311 (98.4%) |

654,592 (1.6%) |

Rights of Minority Shareholders

We remain attentive to the opinions of our minority shareholders and ensure that the following rights are protected in relation to general shareholders’ meetings.